The Magyar Nemzeti Bank (MNB) has solidified its position as being among the group of leading central banks supporting sustainable financial practices. Using the publicly available methodology of the Green Central Banking Scorecard, the MNB voluntarily assessed its green activities to gauge its performance and identify areas of potential further improvement. The self-assessment was checked and validated by Positive Money, which conducts the research and analysis for the scorecard. We present the results as follows.

In recent years, it has become an intense discussion topic how the negative consequences of climate change could potentially interfere with traditional central bank mandates. As a result, more and more central banks realized the importance of the topic and came up with various green initiatives. In accordance with its sustainability mandate, the MNB is dedicated to continuing further advancements in promoting green finance initiatives. The most important goal is to change the entire mindset around climate change.

The MNB represents its green mandate in many areas and thus sets a good example for the greening of the economy. Such events and initiatives are, for example, the MNB’s annual Green Finance Conferences and Green Finance Science Awards, green monetary policy measures such as the Green Mortgage Bond Purchase Program, the Green Home Program, the green preferential haircuts in collateral framework, the build-up of a dedicated green bond portfolio, and the Charter of Sustainable and Responsible Investment concerning the management of foreign exchange reserves. Furthermore, supervisory and regulatory actions including the Green Recommendations to the financial and insurance sectors, the Green Preferential Capital Requirement Program and climate stress tests, and macroprudential policies like the amendments to the Mortgage Funding Adequacy Ratio regulation.

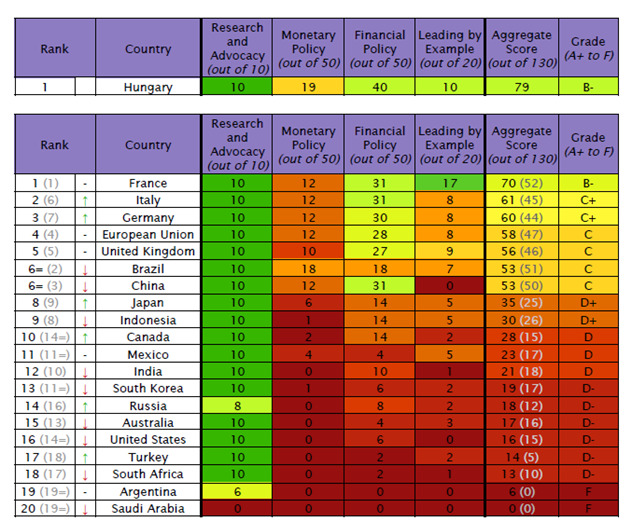

The Green Central Banking Scorecard - developed by Positive Money, an independent London-based nonprofit research organization -, serves as an excellent reference for evaluating and comparing central banks' environmental sustainability efforts. In the scorecard a total of 130 points can be obtained in four dimensions: i) research and advocacy (max. 10), ii) monetary policy (max. 50), iii) financial supervisory policies (max. 50) and iv) leading by example (max. 20).

Using the publicly available methodology of the Scorecard, the MNB voluntarily assessed its green activities to gauge its performance and identify areas of potential further improvement. The assessment was checked and validated by Positive Money, which conducts the research and analysis for the scorecard. Based on this, the MNB would be ahead of all G20 countries in Positive Money’s ranking.

The MNB’s regular publications, like the Climate-Related Financial Disclosures (TCFD reports) and Green Finance Reports were also valued positively, as well as the fact that the MNB reduced the CO2 emissions of its own operations by 60% by 2022 and set new goal of achieving a 75% reduction by 2025 (compared to 2019).

With its proactive steps the MNB aims to set an example and encourage all financial market players to integrate sustainability practices into their operations as widely as possible.

How the MNB stacks up against G20 countries from the 2022 Scorecard

Source: Positive Money