The Funding for Growth Scheme (FGS) has played a key role in stopping steady contraction in corporate, particularly SME lending in 2013. However, a robust rebound in lending has not yet occurred; the credit growth essential for a long-term and sustainable economic recovery has not yet started. Banks’ risk aversion has not changed, lending outside the FGS is characterised by excessive caution. The volume of outstanding borrowing in this segment continued to decrease, as in previous years, despite the significant cuts of policy rate. A vast part of creditworthy enterprises has no access to FGS, and outside the FGS they will only receive loans for short term, at unjustifiably high interest rates, which suggesting impaired monetary policy transmission. The MNB considers it necessary to promote lending to such enterprises, which can be achieved by the extension of the FGS. This aim can be accomplished by the central bank assuming some of the SME credit risk from the credit institutions to a limited extent and for a limited term in relation to refinancing operation.

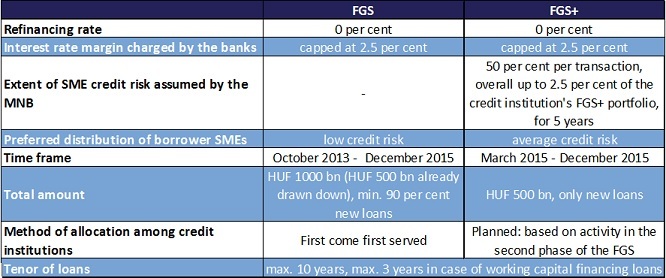

The Monetary Council today decided to launch the FGS+, which is separate from the FGS scheme, running parallel with it, but shows several similarities. Under the FGS+, the Magyar Nemzeti Bank will make available HUF 500 billion for the credit institutions. The 0 per cent refinancing rate of the central bank liquidity provisioning under the FGS+ is available for lending to small and medium sized enterprises in the same way, with a lending rate capped at 2.5 per cent. However, the new lending programme has an additional important condition, in order to normalise the credit market of those enterprises as well that have no access to the FGS. In the FGS+, the MNB takes over 50 per cent of credit losses from the credit institutions, but only for a term not exceeding 5 years and up to 2.5 per cent of the entire loan portfolio held by the individual credit institutions under this scheme. Forint refinancing operation under the FGS+ will be available for all comparable market players at the same conditions. By this the MNB encourages the banks to provide long-term funding at a fixed interest rate, as a result of decreasing credit risk costs, not only to prime customers, but also to customers with medium creditworthiness constituting the majority of the SME credit market. The central bank expects that this programme will remove the barriers to access to credit for a significant portion of creditworthy SMEs.

Limited both in time and size, the risk assumption by the MNB in relation to refinancing operation is intended to remedy a temporary market distortion, the inadequate operation of the risk-taking channel of monetary policy transmission, in other words the excessive risk aversion despite the current low interest rate environment. At present, as part of the MNB’s monetary policy instruments, the only way of remedy available for the MNB is the partial, limited assumption of credit risk from credit institutions in relation to refinancing operation. Since in Hungary the regulation of a securitisation enabling bundling SME loans is still under development, the MNB is unable to launch an asset purchase programme, similar to those applied by other central banks in developed countries. Therefore, the MNB is not able or willing to bypass the banking sector; through the FGS+ it tries to alleviate the disturbances of the SME credit market with the intermediation of credit institutions.

The FGS and FGS+ both terminated at the end of 2015, are the central bank’s temporary, targeted monetary policy instruments, which are designed to adjust the distortions of the SME credit market. From the beginning of 2016, SME lending can gradually return to restored market-based conditions.

In the near future, the central bank will consult with representatives of the financial and the business sector and it will finalise the detailed rules of the FGS+ to be launched on 16 March 2015. The detailed background document on the reasoning of FGS+ is available here.

Comparison of the major parameters of the FGS and FGS+