07 September 2022 The Magyar Nemzeti Bank will hold, in addition to the regular, daily T/N FX swap tenders providing euro liquidity, two further FX swap tenders and two short-term discount bill auctions in September 2022. The purpose of the MNB’s active market presence is to strengthen the efficiency of monetary transmission, thereby supporting the achievement and maintenance of price stability.

In order to strengthen the efficiency of monetary transmission and thereby support the achievement and maintenance of price stability, in addition to the regular, daily one-day (T/N) FX swap tenders the MNB will hold two further FX swap tenders providing euro liquidity (one with two-week and one with overnight (O/N) maturity) and two short-term discount bill auctions in September 2022. During the end-of-quarter period the MNB provides the regular daily T/N swap tenders in an unchanged manner. The Bank may use its international master repurchase agreements providing euro liquidity to finance the swap instrument. The notice on the swap facility providing euro liquidity is available at the following link: Information notice.

Following the Monetary Council’s decision on 16 November 2021, the MNB’s set of monetary policy instruments has been complemented by a discount bill with a maturity of up to one month, announced on a discretionary basis. The instrument aims to reduce potential tensions in the swap market building up at the end of each quarter and thereby strengthen the efficiency of monetary transmission by providing targeted support to the banking system to deleverage. The Information Sheet of the central bank discount bill is available at the following link: Short-term discount bill.

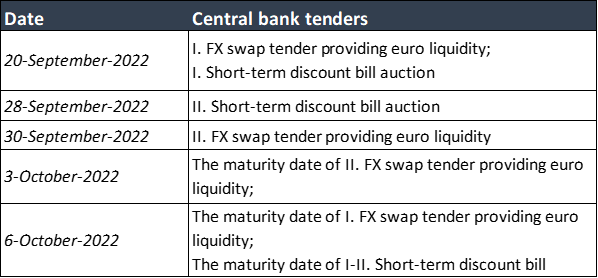

The additional FX swap tenders will take place on 20 and 30 September and the discount bill auctions will be held on 20 and 28 September. The starting value date of the first FX swap tender and the first central bank discount bill will be 22 September. The starting value date of the second central bank discount bill will be 29 September. The starting value date of the second FX swap tender with overnight maturity will be 30 September. The maturity date of the first FX swap and the first and second discount bill transactions will be 6 October, and the maturity date of the second FX swap tender will be 3 October 2022.

The announcement containing the parameters of EUR/HUF FX swap tenders of 20 and 30 September 2022 will be published on the Bank’s and news agencies’ websites at 09:00 CEST on the day of the tender. The public offers of the central bank discount bills will be published on 15 and 23 September and the calls for bids will be published on 19 and 27 September.