Budapest, December 19, 2023. In December 2023, the Magyar Nemzeti Bank (MNB) will hold a year-end foreign exchange swap tender providing euro-liquidity, in addition to the regularly used instruments. The aim of the MNB's active market presence is to strengthen the effectiveness of monetary transmission, and to maintain market stability through the support of bank balance sheet adjustment.

In addition to maintaining the daily T/N foreign exchange swap tenders and the discount bill auctions announced on Wednesdays, the MNB will hold a year-end foreign exchange swap tender providing euro liquidity with one-week maturity on 21 December. Among the instrument regularly used, the discount bill auction on December 27 and the T/N FX swap tender on December 28 also support the end-of-year adjustment.

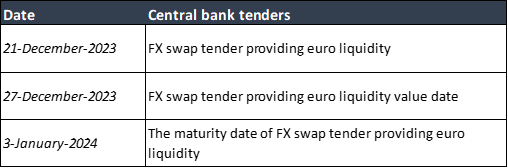

The year-end, one-week foreign exchange swap tender date is December 21, with T+2 settlement day the value date is December 27. The one-week foreign exchange swap deal expire on January 3, 2024. The MNB publishes the call for bids containing the parameters of the euro/forint foreign exchange swap tender on tender day at 9:00 a.m. on the central bank's website and on news agency websites. The MNB can use its international repo agreements that provide euro liquidity to finance its foreign exchange swap tenders that extend through the end of the year.

The Notice for Terms and Conditions of the FX swap providing euro liquidity is available at the following link: Notice. The Information sheet of the central bank discount bill is available at the following link: Information sheet.

Important dates of the one-week currency swap tender at the end of 2023*

*The regular daily T/N FX swap tenders providing euro liquidity and the weekly discount bill auctions will be kept unchanged according to the usual time schedule.