1 December 2025

On 17 December, the Magyar Nemzeti Bank will hold a three-week central bank bill auction, and on 18 December, a year-end foreign exchange swap tender providing euro liquidity, in addition to its regular instruments. The aim of the MNB’s market presence is to strengthen the effectiveness of monetary policy transmission and to ensure stability in the FX swap market even at the end of the year.

In line with its previous practice, the Magyar Nemzeti Bank (MNB) pays special attention to the expected state of the FX swap market at the end of the year. In order to ensure the effectiveness of monetary policy transmission, the MNB, in addition to its regular T/N FX swap tenders and one-week discount bill auctions, will hold a year-end, three-week central bank bill auction on 17 December 2025, and a two-week foreign exchange swap tender providing euro liquidity, on 18 December 2025.

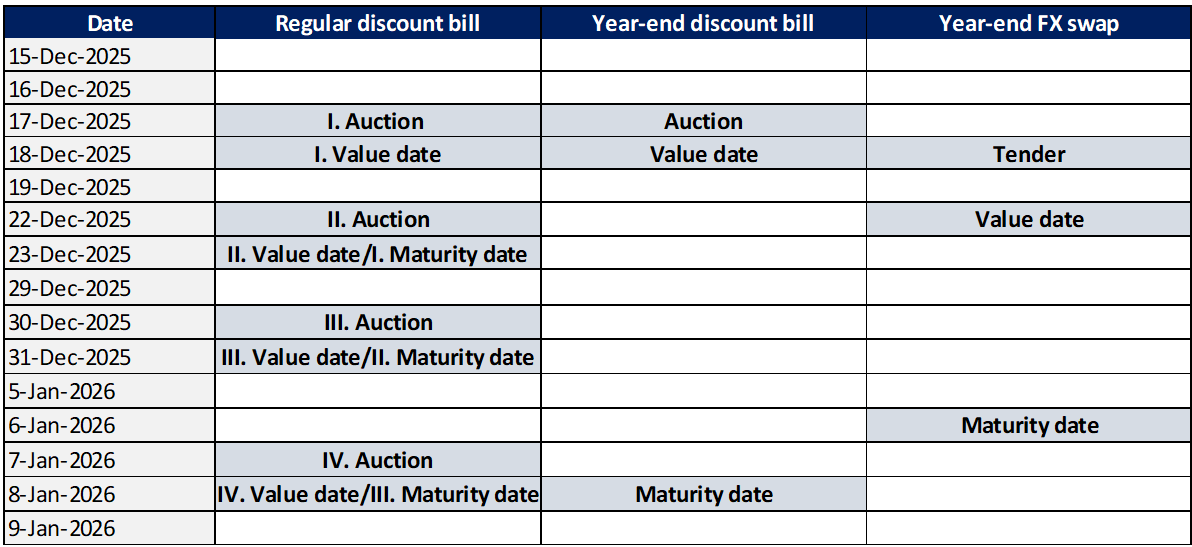

The three-week central bank discount bill auction is scheduled for 17 December 2025, with settlement at T+1, a value date of 18 December 2025, and a maturity of 8 January 2026. The three-week central bank discount bill auction will be held on 17 December 2025, at the same time as the regular bill auction. The year-end foreign exchange swap tender is scheduled for 18 December 2025, with a T+2 settlement, a value date of 22 December and a maturity of 6 January 2026. The year-end foreign exchange swap tender will be held at the same time as the regular T/N FX swap tender on 18 December 2025.

The MNB will publish the tender notices with the details of the additional FX swap instrument and the central bank discount bill on its website and its new agency pages at 9:00 am on 17 December 2025. The MNB may use its international repo agreements for the provision of euro liquidity to finance its year-end FX swap tenders.

With regards to the public holidays in December 2025, the regularly used central bank discount bill will be announced differently from usual. The value date of the regular one-week central bank discount bill, to be auctioned on 17 December 2025, is 18 December 2025 and its maturity date is 23 December 2025. The second to last bill auction of the year will be held on 22 December 2025, with a value date of 23 December 2025 and a maturity date of 31 December 2025. In line with this, the last regular bill auction of the year will be held on 30 December 2025, with a value date of 31 December 2025 and a maturity date of 8 January 2026. During the period, regular T/N FX swap tenders will be announced as usual.

The Notice on the Terms and Conditions of the FX swap providing euro liquidity is available at the following link: Notice. Information on the central bank discount bill is available at the following link: Information sheet.

Important dates of the central bank tenders in December 2025