Week 1

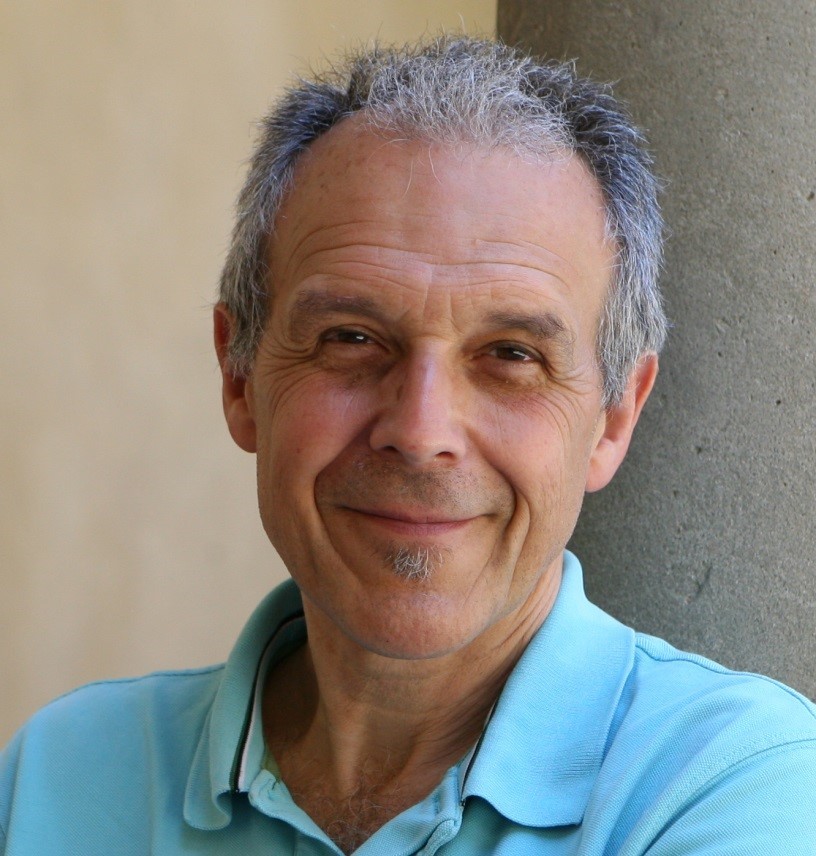

Fabio Canova is a professor of Macroeconomics at the Norwegian Business School, Research associate with the Centre for Applied Macroeconomics and Petroleum Studies and the CEPR. He is also program director of the Budapest School of Central Bank Studies and a member of the scientific committee of the Euro Area Business Cycle network.

Fabio Canova is a professor of Macroeconomics at the Norwegian Business School, Research associate with the Centre for Applied Macroeconomics and Petroleum Studies and the CEPR. He is also program director of the Budapest School of Central Bank Studies and a member of the scientific committee of the Euro Area Business Cycle network.

In the past he has held the Pierre Werner chair in Monetary Union at the Robert Schumann Center for Advanced Studies (2012-2014), The ICREA Research Professorship at Universitat Pompeu Fabra (2006-2012) and has been Professor of Econometrics at the European University Institute (2011-2014) and Chair in Monetary Economics and the University of Bern (2008). He has been recently awarded an honorary professorship from Henin University in China.

In the recent past he has been program committee member of the meetings of the International Association of Applied Econometrics (2014-2017), chair for the European Meetings of the Econometric Society 2014, a panelist of ANVUR in 2013, coeditor of the Journal of the European Economic Association from 2008 to 2013 and of the Journal of Applied Econometrics from 2012 to 2017, and a referee for ERC, NSF, ESRC research proposals.

Has has taught classes in numerous universities and given professional courses in Central banks and international institutions. He has published over 85 articles in international journals and his graduate textbook, Methods for Applied Macroeconomic Research, has been published in 2007 by Princeton University Press and translated in Chinese in 2010.

website: http://apps.eui.eu/Personal/Canova/

Week 2

Francesco Lippi is full professor at LUISS University and a senior fellow at the Einaudi Institute of Economics and Finance in Rome (EIEF). His research mainly concerns monetary economics, where has has published extensively about the propagation of monetary shocks, money demand, and monetary institutions (monetary unions and their interactions with wage setting institutions). He received his PhD from the Tinbergen Institute of Rotterdam. Between 1998 and 2006 he was a member, and later the head, of the Monetary Analysis Unit at the Research Department of the Bank of Italy. He has been published in the top peer-reviewed international journals in economics and has been awarded several prestigious international grants such as the prize of the Foundation Banque de France (twice) and a 5-year Advanced Grant by the European Research Council in 2013.

Francesco Lippi is full professor at LUISS University and a senior fellow at the Einaudi Institute of Economics and Finance in Rome (EIEF). His research mainly concerns monetary economics, where has has published extensively about the propagation of monetary shocks, money demand, and monetary institutions (monetary unions and their interactions with wage setting institutions). He received his PhD from the Tinbergen Institute of Rotterdam. Between 1998 and 2006 he was a member, and later the head, of the Monetary Analysis Unit at the Research Department of the Bank of Italy. He has been published in the top peer-reviewed international journals in economics and has been awarded several prestigious international grants such as the prize of the Foundation Banque de France (twice) and a 5-year Advanced Grant by the European Research Council in 2013.

website: http://www.eief.it/eief/index.php/people/faculty?id=173

Week 3

Gianni De Nicolo, PhD (Economics, University of Minnesota) is Associate Professor at the Johns Hopkins University (JHU) Carey Business School. Before joining JHU, he worked at the IMF in the IMF Institute, the Research Department and the Monetary and Capital Markets Department. Before joining the IMF, he was Lecturer at the University of Rome “La Sapienza”, Assistant Professor at Brandeis University, and Economist in the Division of International Finance at the Board of Governors of the Federal Reserve System. His research includes theoretical models of banking with empirical applications, banking regulation, and macroeconomic and financial modeling of systemic risks.

Gianni De Nicolo, PhD (Economics, University of Minnesota) is Associate Professor at the Johns Hopkins University (JHU) Carey Business School. Before joining JHU, he worked at the IMF in the IMF Institute, the Research Department and the Monetary and Capital Markets Department. Before joining the IMF, he was Lecturer at the University of Rome “La Sapienza”, Assistant Professor at Brandeis University, and Economist in the Division of International Finance at the Board of Governors of the Federal Reserve System. His research includes theoretical models of banking with empirical applications, banking regulation, and macroeconomic and financial modeling of systemic risks.

website: https://carey.jhu.edu/faculty-research/faculty-directory/gianni-de-nicolo-phd

Week 4

Christopher Carroll is an NBER Research Associate in the programs on Monetary Economics and Economic Fluctuations and Growth, and Professor of Economics at the Johns Hopkins University in Baltimore. Past positions include Chief Economist at the Consumer Financial Protection Bureau (2014-15), Senior Economist at the Council of Economic Advisors (2009-10 and 1997-98), and Economist at the Federal Reserve Board (1990-95).

Christopher Carroll is an NBER Research Associate in the programs on Monetary Economics and Economic Fluctuations and Growth, and Professor of Economics at the Johns Hopkins University in Baltimore. Past positions include Chief Economist at the Consumer Financial Protection Bureau (2014-15), Senior Economist at the Council of Economic Advisors (2009-10 and 1997-98), and Economist at the Federal Reserve Board (1990-95).

Professor Carroll's research has primarily focused on consumption and saving behavior, with an emphasis on reconciling empirical evidence from both microeconomic and macroeconomic sources with structural models with ``serious'' microfoundations: Models that match the features of microeconomic evidence that theory says could matter for macroeconomic outcomes, including evidence on income risk, the distribution of income, and the distribution and composition of wealth.

His main recent project has been the construction of an open-source toolkit for construction and use of such models, the [Econ-ARK](https://econ-ark.org) toolkit.

website: http://econ.jhu.edu/directory/christopher-carroll/

Week 5

Daniel Waggoner is a research economist and adviser on the macroeconomics and monetary policy team in the research department of the Federal Reserve Bank of Atlanta. His interests include Bayesian econometrics, economic and mathematical modeling, and programming for high performance computing environments.

Daniel Waggoner is a research economist and adviser on the macroeconomics and monetary policy team in the research department of the Federal Reserve Bank of Atlanta. His interests include Bayesian econometrics, economic and mathematical modeling, and programming for high performance computing environments.

Before joining the Fed, he was an assistant professor of mathematics at Agnes Scott College and, before that, a visiting assistant professor at Lehigh University. Dr. Waggoner's work has been published in a number of journals, including Econometrica, Review of Economic Studies, Journal of Econometrics, and Transactions of the American Mathematical Society.

Dr. Waggoner earned his bachelor's degree in mathematics from the University of Mississippi. He earned a master's degree and a doctorate in mathematics from the University of Kentucky. He also holds a master's degree in finance from Georgia State University.

website: http://www.danielwaggoner.net/