The projections, produced quarterly by the Magyar Nemzeti Bank, set out expected future developments in the major macroeconomic variables in a transparent manner. Because the projections prepared by Bank staff constitute one of the most important sources of information for monetary policy decision making, they play a key role in guiding economic agents’ expectations about monetary policy.

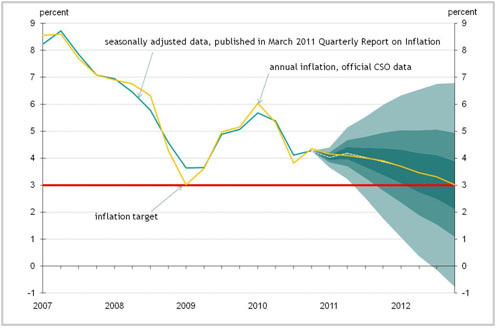

The projections of the future path of inflation are presented by the Bank in what is known as the ‘fan chart’. In addition to the baseline projection, the fan chart is also capable of giving a range of forecast uncertainty around the central projection. The projections in the current issue of the Quarterly Report on Inflation are presented using the results derived from the Bank’s new forecasting framework. Because the Bank’s forecasting systems use seasonally adjusted quarterly time series as inputs, the results are similar in form. This method of managing data may lead to misunderstandings about the short-term inflation projections. This background material therefore summarises the information necessary to have a clear understanding of the fan chart.

The Report fan chart portrays annual inflation calculated on the basis of seasonally adjusted data. However, the annual consumer price index, published by the Central Statistical Office, is not adjusted for seasonal effects. Although, in principle, seasonal effects are less likely to influence the annual consumer price index, there may be a gap of a couple of tenths of a percentage point between the two indicators. The reason for these differences are that declining demand during the financial crisis and the frequent indirect tax measures of past years have significantly affected the seasonal patterns of price changes.

Given its occurrence over past quarters, this difference also appears in the current short-term projection. Staff’s projection for the CSO consumer price index – which is not seasonally adjusted – is slightly higher than the annual index adjusted for seasonal effects in 2011 Q1. However, it is important to note that on the horizon relevant for monetary policy the effects of this distortion wear off (because the seasonal factors remain unchanged over the forecast period). Consequently, the 3% inflation target may be met at the end of 2012 according to both time series. Taking into account that the Magyar Nemzeti Bank set his inflation target for the officially published CSO inflation data, following past practice, in the future the projection in the fan chart shown below, containing seasonal effects, will be published, in order to allow the most precise interpretation. The fan chart will be modified both in the March Report text and the chart-pack at the time this background information is issued.